Structure Self-confidence: Dependable Trust Foundations

Structure Self-confidence: Dependable Trust Foundations

Blog Article

Enhance Your Legacy With Expert Trust Fund Foundation Solutions

Professional count on foundation solutions offer a durable structure that can guard your properties and guarantee your desires are carried out precisely as planned. As we dive right into the nuances of count on foundation solutions, we reveal the vital components that can fortify your legacy and provide a long-term effect for generations to come.

Advantages of Depend On Foundation Solutions

Trust structure options provide a durable structure for guarding possessions and guaranteeing long-term economic safety for individuals and companies alike. One of the primary advantages of count on structure options is asset defense. By establishing a trust, people can shield their properties from prospective threats such as claims, creditors, or unpredicted financial commitments. This security ensures that the possessions held within the trust fund stay secure and can be handed down to future generations according to the person's desires.

Through trusts, individuals can detail just how their assets ought to be taken care of and dispersed upon their death. Trust funds additionally provide privacy benefits, as assets held within a count on are not subject to probate, which is a public and typically prolonged legal process.

Kinds Of Trusts for Heritage Preparation

When taking into consideration heritage preparation, a vital element includes exploring various sorts of lawful tools made to protect and distribute assets effectively. One usual kind of depend on utilized in heritage planning is a revocable living trust. This trust permits individuals to maintain control over their properties during their lifetime while guaranteeing a smooth change of these properties to beneficiaries upon their passing away, staying clear of the probate process and providing personal privacy to the family.

Philanthropic trusts are likewise preferred for individuals looking to sustain a reason while maintaining a stream of earnings for themselves or their recipients. Unique needs counts on are essential for individuals with specials needs to guarantee they receive required treatment and assistance without jeopardizing government benefits.

Comprehending the various types of depends on readily available for legacy planning is vital in developing a detailed approach that straightens with individual goals and concerns.

Selecting the Right Trustee

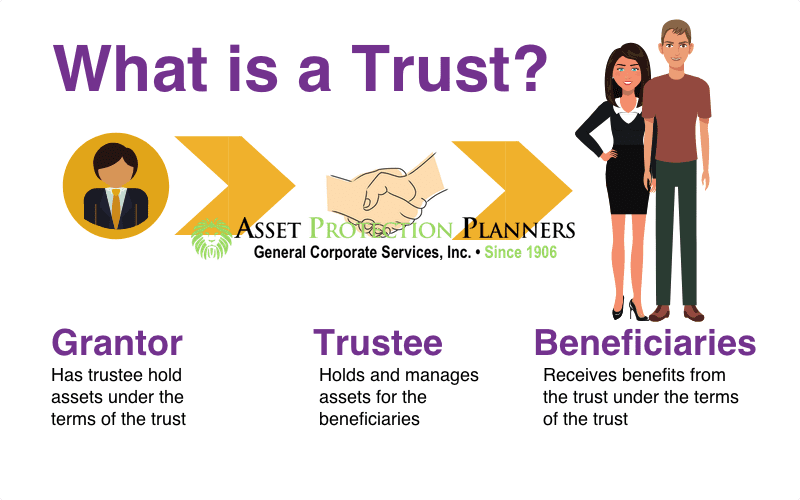

In the realm of tradition planning, a vital aspect that requires mindful factor to consider is the choice of a proper person to accomplish the crucial role of trustee. Choosing the right trustee is a decision that can considerably impact the successful execution of a trust and the fulfillment of the grantor's wishes. When choosing a trustee, it is vital to prioritize high qualities such as credibility, monetary acumen, integrity, and a commitment to acting in the best interests of the recipients.

Preferably, the selected trustee ought to have a strong understanding of monetary issues, can making sound financial investment choices, and have the capability to browse intricate legal and tax obligation demands. Furthermore, reliable interaction skills, focus to detail, and a willingness to act impartially are additionally important attributes for a trustee to have. It is suggested to choose a person who is reliable, accountable, and with the ability of meeting the tasks and responsibilities related to the function of trustee. By carefully thinking about these factors and picking a trustee that straightens with the worths and objectives of the count on, you can help make certain the lasting success and conservation of your legacy.

Tax Ramifications and Benefits

Considering the Visit This Link financial landscape view publisher site bordering depend on structures and estate planning, it is vital to dive right into the intricate realm of tax implications and benefits - trust foundations. When establishing a trust, comprehending the tax obligation effects is essential for optimizing the benefits and reducing prospective obligations. Counts on supply various tax benefits relying on their framework and function, such as minimizing estate tax obligations, earnings taxes, and gift tax obligations

One considerable advantage of specific count on structures is the ability to move properties to recipients with minimized tax effects. For instance, irreversible depends on can eliminate assets from the grantor's estate, possibly decreasing estate tax liability. Additionally, some trusts permit for earnings to be distributed to recipients, who may remain in lower tax braces, resulting in total tax savings for the family members.

Nevertheless, it is crucial to note that tax obligation laws are intricate and subject to alter, emphasizing the need of consulting with tax obligation professionals and estate planning professionals to ensure conformity and make best use of the tax advantages of count on structures. Correctly browsing the tax ramifications of counts on can lead to substantial savings and a much more reliable transfer of riches to future generations.

Actions to Establishing a Depend On

The very first action in developing a trust is to clearly define the purpose of the count on and the possessions that will certainly be consisted of. Next off, it is vital to pick the kind of trust fund that ideal straightens with your objectives, whether it be a revocable count on, irreversible count on, or living depend on.

Final Thought

In conclusion, establishing a trust fund structure can offer numerous advantages for tradition planning, consisting of property defense, control over circulation, and tax benefits. By choosing the suitable kind of trust fund and trustee, individuals can safeguard their properties and ensure their wishes are executed according to their needs. Comprehending the tax effects and taking the required actions review to develop a depend on can assist reinforce your tradition for future generations.

Report this page